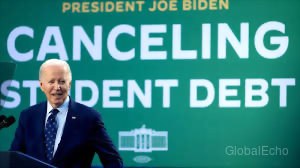

The landscape of student loans in the United States has undergone a dramatic shift in recent years, largely due to expansive federal loan forgiveness programs. President Biden's administration has implemented several initiatives aimed at providing substantial relief to millions of borrowers burdened by student loan debt. This article delves into the intricacies of these programs, examines their impact, and explores the Ongoing debate surrounding the future of student loan forgiveness.

The Biden Administration's Loan Forgiveness Plans: A Closer Look

The Biden-Harris administration's student loan forgiveness plan represents one of the most significant government interventions in student loan debt in history. The program aimed to provide targeted relief to borrowers facing financial hardship, particularly those who attended institutions with predatory lending practices or experienced unforeseen Economic setbacks. Multiple rounds of forgiveness have been announced, culminating in a final round totaling nearly $189 billion in aid. This substantial investment underscores the administration's commitment to addressing the pervasive issue of student loan debt and its negative impact on borrowers’ financial well-being. These programs have targeted specific groups, including those who attended institutions like Ashford University, which resulted in significant debt cancellation for 260,000 former students. The sheer scale of these initiatives highlights the magnitude of the student loan debt crisis and the government's efforts to mitigate its effects.

While the program has brought significant relief to many, it has also faced considerable scrutiny. Legal challenges have questioned the administration’s authority to implement such sweeping forgiveness programs without explicit congressional authorization. These challenges highlight the Ongoing debate surrounding the legality and efficacy of large-scale student loan forgiveness initiatives. Furthermore, the administration's actions have ignited a discussion about the long-term sustainability of the federal student loan system and the need for comprehensive reforms to address the root causes of student loan debt.

The Impact of Loan Forgiveness on Borrowers

For many borrowers, the loan forgiveness programs have offered a lifeline. The cancellation of thousands of dollars in debt can have a transformative effect on individuals' financial lives, enabling them to pursue homeownership, start families, and invest in their futures. The reduced financial burden can alleviate significant stress and improve overall financial health. For those struggling with debt, the forgiveness represents a chance to start fresh and build a more secure Future. This impact is particularly pronounced for those who attended for-profit colleges that had questionable lending practices, as in the case of Ashford University, which saw 260,000 former students receive debt relief.

THESE 25 BANKS APPROVE EVERYONE WITH LOW FICO IN 2025! NO CREDIT CHECK EVER!

The Broader Economic Implications of Student Loan Forgiveness

Beyond the individual benefits, the economic implications of large-scale loan forgiveness are far-reaching and complex. Proponents argue that it stimulates economic growth by freeing up disposable income for borrowers, leading to increased consumer spending and investment. It's suggested that this injection of capital into the economy can have a positive ripple effect, creating jobs and boosting economic activity. However, critics argue that loan forgiveness could lead to inflation, increase the national debt, and disproportionately benefit higher earners. The Debate about the broader economic impact remains a contentious one, with economists offering diverse perspectives and predictions.

Addressing the Root Causes of Student Loan Debt

While loan forgiveness offers immediate relief, it’s crucial to address the underlying causes of the student loan debt crisis. The rising cost of higher education, coupled with stagnant wages and limited access to affordable financial aid, are key factors contributing to the problem. Reforms focusing on controlling tuition costs, increasing financial aid accessibility, and promoting alternative pathways to higher education are essential to prevent Future crises. A comprehensive approach requires a multi-pronged strategy that involves universities, policymakers, and financial institutions.

The Future of Student Loans and Forgiveness

The future of student loan forgiveness remains uncertain. While the Biden administration's initiatives represent a significant step towards addressing the issue, the long-term sustainability and broader implications remain subjects of intense debate. The legal challenges and Ongoing political discussions surrounding loan forgiveness will likely shape the future of federal student loan programs. Finding a sustainable solution that balances the needs of borrowers with the fiscal realities of the nation will require careful consideration and collaboration amongst stakeholders.

Looking Ahead: Solutions and Reforms

Moving forward, several potential solutions and reforms deserve consideration. These include exploring income-driven repayment plans that better reflect borrowers' financial capacity, implementing stricter regulations on for-profit colleges, and investing in affordable higher education alternatives. Furthermore, open discussions about the role of government in subsidizing higher education and the long-term sustainability of the current system are crucial. A comprehensive approach that addresses both immediate relief and long-term reform is essential to navigate the complexities of student loans and ensure a more equitable and sustainable Future for higher education.

The Ongoing debate about student loans highlights the need for informed discussion, thoughtful policymaking, and a commitment to addressing this critical issue that affects millions of Americans. Finding a balanced approach that balances the need for immediate relief with long-term solutions is vital to ensuring a more accessible and affordable higher education system for future generations.

Comments

Leave a Comment