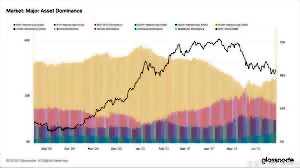

The Cryptocurrency market is a complex and dynamic ecosystem, constantly shifting in response to various factors. One key indicator frequently watched by traders and analysts is Bitcoin dominance – the percentage of the total cryptocurrency market capitalization represented by Bitcoin. Recently, Bitcoin dominance has experienced a significant rebound, reaching 57%, leading to speculation about a potential price rally for Bitcoin (BTC).

Understanding Bitcoin Dominance

Bitcoin dominance acts as a barometer for the overall health and sentiment within the Cryptocurrency market. A high Bitcoin dominance suggests investors are favoring Bitcoin over altcoins (alternative cryptocurrencies). Conversely, a low Bitcoin dominance indicates increased investor interest in the broader altcoin market, often referred to as "altcoin season." Understanding the fluctuations in Bitcoin dominance is crucial for navigating the volatile cryptocurrency landscape.

Historically, periods of high Bitcoin dominance have often been followed by periods of consolidation or even price increases for Bitcoin. However, it's important to remember that correlation doesn't equal causation. Other factors, such as regulatory changes, technological advancements, and macroeconomic conditions, significantly influence Bitcoin's price and overall market sentiment.

Factors Influencing Bitcoin Dominance

Several factors contribute to the shifts in Bitcoin dominance. These include:

- Investor Sentiment: Positive sentiment towards Bitcoin often leads to capital flowing back into BTC, increasing its dominance. Negative news or regulatory uncertainty can trigger a shift towards altcoins.

- Altcoin Performance: A strong rally in altcoins can dilute Bitcoin's market share, lowering its dominance. Conversely, underperformance by altcoins can drive investors back to Bitcoin.

- Macroeconomic Factors: Global economic events, such as inflation or recessionary fears, can impact investor risk appetite. During times of uncertainty, investors may flock to Bitcoin as a perceived safe haven asset, boosting its dominance.

- Technological Developments: Significant advancements in Bitcoin's technology or the introduction of innovative features can attract new investors, increasing its dominance.

- Regulatory Landscape: Favorable regulatory developments for Bitcoin in key jurisdictions can lead to increased institutional investment, boosting its market share.

The Recent Rebound: A Signal for a Bitcoin Rally?

The recent rebound of Bitcoin dominance to 57% has ignited discussions about a potential price rally. While a correlation between rising Bitcoin dominance and price increases exists historically, it's not guaranteed. The current situation warrants careful consideration of multiple factors. Many analysts, including those at Panda Traders (@Panda_Traders), are closely monitoring this trend for potential trading opportunities. Binance's insights (https://www.binance.com/en/square/post/19409156156426) also provide valuable context.

Bitcoin Dominance UPDATE

Articles like the one published by Bitcoinist (https://bitcoinist.com/bitcoin-dominance-rebounds-to-57-rally-to-follow/) highlight the potential for a price rally, but caution against relying solely on this indicator. A comprehensive analysis of other market factors is essential.

Historical Context and Future Predictions

Examining historical data on Bitcoin dominance reveals periods of both high and low dominance, often coinciding with significant price movements. However, predicting future price movements solely based on Bitcoin dominance is unreliable. A holistic approach, incorporating various technical and fundamental analyses, is crucial for informed decision-making.

While the recent rebound is noteworthy, it is essential to consider the broader macroeconomic climate and the overall sentiment within the Cryptocurrency market. Unexpected events can significantly impact Bitcoin's price and market dominance, rendering any prediction uncertain.

The Importance of Diversification

Regardless of Bitcoin dominance levels, diversification within a Cryptocurrency portfolio remains a crucial risk management strategy. Reliance on a single asset, even Bitcoin, exposes investors to significant potential losses. A well-diversified portfolio can mitigate risk and improve overall portfolio performance.

Conclusion (Implicit within the text)

The rebound of Bitcoin dominance to 57% presents a compelling development in the Cryptocurrency market. While it suggests a potential price rally for Bitcoin, it's crucial to avoid drawing definitive conclusions based solely on this indicator. A comprehensive analysis of multiple factors, including market sentiment, altcoin performance, macroeconomic conditions, and regulatory developments, is necessary for a thorough understanding of the current market dynamics and potential future trends. Remember that the cryptocurrency market is inherently volatile, and prudent risk management practices, such as diversification, are paramount.

Comments

Leave a Comment